Insurance plan security is a kind of things which we often neglect right up until we actually need it. It is really the safety Internet that will capture us when everyday living throws us a curveball. Whether it's a unexpected health-related emergency, an automobile incident, or damage to your private home, coverage defense makes sure that you are not left stranded. But, what exactly will it mean to possess insurance policy defense? And how Did you know in case you are really coated? Let us dive into the earth of insurance coverage and take a look at its several facets that may help you understand why it's so important.

Some Known Factual Statements About Insurance Solutions For Contractors

1st, Enable’s discuss what insurance policy safety genuinely is. It’s basically a contract concerning you and an insurance provider that claims financial help from the party of the reduction, problems, or personal injury. In Trade for just a every month or annual top quality, the insurance provider agrees to go over sure risks that you might confront. This security will give you relief, figuring out that if the worst occurs, you won’t bear the entire money load by yourself.

1st, Enable’s discuss what insurance policy safety genuinely is. It’s basically a contract concerning you and an insurance provider that claims financial help from the party of the reduction, problems, or personal injury. In Trade for just a every month or annual top quality, the insurance provider agrees to go over sure risks that you might confront. This security will give you relief, figuring out that if the worst occurs, you won’t bear the entire money load by yourself.Now, you might be wondering, "I’m healthy, I drive carefully, and my property is in great shape. Do I really need coverage safety?" The reality is, we can in no way predict the longer term. Mishaps occur, illness strikes, and normal disasters happen devoid of warning. Coverage defense acts being a safeguard against these unforeseen functions, helping you handle expenses when things go Improper. It’s an financial investment in the long term very well-currently being.

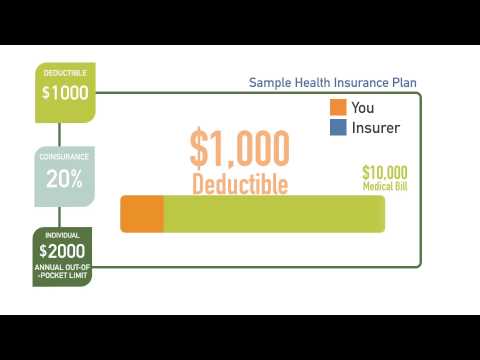

Just about the most popular varieties of insurance policies safety is health and fitness coverage. It covers medical expenses, from plan checkups to crisis surgical procedures. With out health and fitness insurance policy, even a brief healthcare facility stay could go away you with crippling health-related costs. Health insurance policy permits you to entry the care you will need without worrying regarding the monetary strain. It’s a lifeline in times of vulnerability.

Then, there’s vehicle insurance, which is an additional critical kind of safety. Whether you are driving a brand-new car or truck or an older product, incidents can take place Anytime. With vehicle insurance policies, you might be protected in the event of a crash, theft, or harm to your car. Plus, should you be linked to a mishap where you're at fault, your plan may help include the costs for one other occasion’s car or truck repairs and healthcare expenses. In a means, car insurance policies is sort of a defend defending you from the results in the unpredictable street.

Homeowners’ insurance plan is another very important variety of safety, particularly when you possess your individual property. This coverage protects your home from several different pitfalls, which includes fireplace, theft, or normal disasters like floods or earthquakes. Without having it, you may encounter fiscal spoil if your property ended up to be destroyed or severely weakened. Homeowners’ insurance policies not simply covers repairs, but additionally delivers liability safety if somebody is wounded on the home. It's a comprehensive protection Web for your property and almost everything in it.

Daily life insurance is a person space That always will get ignored, but it’s just as significant. Although it’s not something we would like to think about, lifestyle insurance coverage makes certain that your loved ones are fiscally safeguarded if something were being to happen to you personally. It provides a payout for your beneficiaries, encouraging them cover funeral bills, debts, or living expenditures. Everyday living insurance policies is usually a technique for exhibiting your loved ones you treatment, even Once you're gone.

A different method Gain more info of coverage protection that’s turning out to be more and more well-liked is renters’ insurance coverage. Should you hire your own home or condominium, your landlord’s insurance policy may possibly cover the setting up alone, nonetheless it won’t go over your personal possessions. Renters’ insurance coverage is fairly affordable and might safeguard your belongings in case of theft, fireplace, or other unpredicted functions. It’s a little investment decision that can help you save from important economic loss.

Even though we’re on the topic of insurance policy, let’s not ignore incapacity insurance policy. It’s among the list of lesser-recognized varieties of protection, but it’s incredibly important. Disability insurance delivers cash flow substitution should you grow to be struggling to work on account of sickness or damage. It makes certain that you don’t eliminate your livelihood if some thing unexpected happens, allowing for you to target recovery devoid of stressing regarding your funds. For many who rely on their own paycheck to help make ends meet, disability insurance policies generally is a lifesaver.

Now, Permit’s take a look at the significance of selecting the appropriate coverage provider. With a lot of choices around, it might be too much to handle to pick the appropriate a single for yourself. When deciding upon an insurance company, you want to be certain they provide the protection you will need in a value you are able to afford to pay for. It’s also imperative that you take into account their track record, customer service, and the convenience of filing claims. All things considered, you need an insurance provider that can have your back when you will need it most.

But just getting insurance policy protection isn’t adequate. You furthermore may require to be aware of the terms of your respective coverage. Reading through the fine print might not be pleasurable, however it’s essential to find out precisely what’s covered and what isn’t. Be sure to comprehend the deductibles, exclusions, and restrictions of one's coverage. By doing so, you could avoid horrible surprises when you must file a assert. Expertise is electrical power when it comes to insurance.

Little Known Facts About Insurance Broker Services.

Another element to take into consideration would be the probable for bundling your insurance coverage guidelines. Many insurance policies companies offer bargains if you buy numerous different types of insurance coverage by way of them, which include household and car coverage. Bundling can save you cash even though ensuring that you've got extensive defense in place. So, in case you’re previously searching for a person kind of insurance plan, it would be well worth exploring your options for bundling.The strategy of insurance protection goes outside of own insurance policies likewise. Companies need coverage way too. For those who very own a business, you most likely deal with dangers that will affect your company’s financial well being. Enterprise insurance coverage protects you from a range of challenges, such as property damage, authorized liabilities, and employee-linked challenges. By way of example, general liability coverage may also help safeguard your business if a shopper is wounded on your Know how own premises. Acquiring small business insurance coverage will give you the security to operate your company with no constantly worrying about what could possibly go wrong.